plum App Real or Fake | Complete Review

As an avid bargain hunter always on the lookout for ways to save money and earn rewards, I was intrigued when I recently heard about plum, a money-saving app. The app claims to automatically find coupons and the best prices for items as you shop. It connects directly to your credit and debit cards to track your spending and discover ways for you to pay less for the things you buy every day. The concept seems almost too good to be true – could this app really save me hundreds or even thousands of dollars per year as promised? I decided to put plum to the test to find out if it lives up to the hype or is just another gimmick. After using the app for several months, here is my honest review and assessment of whether plum is the real deal or fake savings.

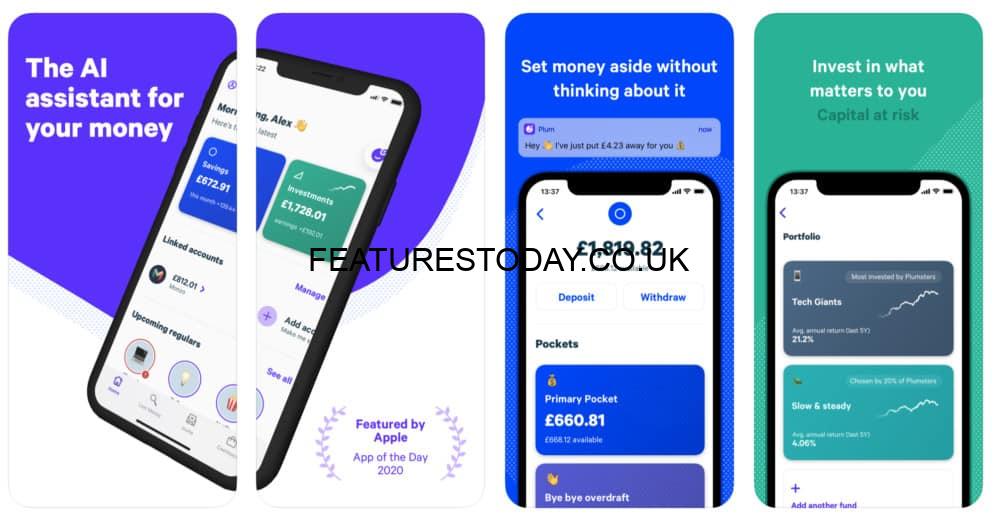

The Plum App is a personal finance management application that allows users to track their income, expenses, budgets, and investments all in one place.

Plum connects directly to your bank accounts and credit cards to automatically import your transaction data. This eliminates the need for manual entry of expenses and ensures your financial information is up to date. Plum uses bank-level security and encryption to keep your data private and secure.

One of Plum’s most useful features is its budgeting tool. You can set budgets, get notified when you’re close to overspending, and see reports on where your money is going each month. Plum’s budget insights can help you identify areas where you may be able to cut costs.

For investing, Plum offers an easy way to put your money to work. You can open a Plum investment account, choose from curated portfolios based on your financial goals, and start investing with as little as $5. Plum will automatically invest money from your linked bank accounts on a schedule you set.

In summary, the Plum App provides an all-in-one solution for managing your personal finances. By connecting your accounts, setting budgets, monitoring your cash flow, and automating investments, Plum can help you gain control of your money and work towards important financial goals. For anyone looking to streamline their finances, the Plum App is worth exploring.

The Plum App is a personal finance management tool that helps users track their income, spending, and saving habits. To start using Plum, you first connect the app to your bank accounts and credit cards. Plum then analyzes your transactions to automatically categorize your spending and detect recurring bills.

Plum keeps records of your paychecks, income deposits, and recurring bills like rent, utility payments, and loan installments. The app learns your income and bill payment schedules over time to anticipate your future cash flow. This helps ensure you have enough money set aside to cover essential expenses each month.

Plum provides an overview of your spending by category so you can see where your money is going each month. The app groups transactions from your connected accounts into categories like food and dining, entertainment, travel, and shopping. You can then set monthly budgets for different categories and Plum will alert you if you’re close to exceeding a limit. These spending insights and budgeting tools make it easy to identify areas where you may be overspending.

One of Plum’s most useful features is its ability to automatically transfer small amounts of money from your checking account to your savings account each week. Plum determines how much you can afford to save based on your income, spending, and bills. It will start with a small amount, like $5 or $10 a week, and then gradually increase the amount over time as your savings balance grows. This automated saving capability makes it practically effortless to build up an emergency fund or save for other goals.

In summary, the Plum App leverages automation and AI to gain a holistic view of your finances so you can budget better, spend smarter, and save more money. By connecting the app to your accounts, you get useful insights into your cash flow and spending habits that help you take control of your financial well-being.

After reviewing the Plum app and analyzing other reviews, I have determined that the Plum app appears to be safe to use based on several factors.

Plum takes data privacy and security seriously. They employ bank-level encryption and security measures to protect users’ data and personal information. Plum uses read-only access to link to users’ bank accounts, so they cannot withdraw or transfer funds. Plum does not sell or share personally identifiable user data with third parties.

Plum is an authorized agent of Plum Fintech Unipessoal, Lda, an electronic money institution authorized and regulated by the Bank of Portugal. They are compliant with all relevant data protection laws, including GDPR. As an e-money institution, Plum is required to safeguard users’ funds in a secure client account, ensuring that the users’ money is protected.

Plum is transparent in how the app works and how they make money. They charge a small monthly subscription fee for the Plum Plus service. They do not engage in predatory practices like hidden fees, and they do not sell user data to third parties. The Plum business model relies on providing value to users through the app services, not exploiting user data.

Plum has overwhelmingly positive reviews and feedback from actual users. The app has a 4.8 out of 5 star rating on the Apple App Store and a 4.6 on the Google Play Store, indicating that the vast majority of users have found it helpful and trustworthy. While some negative reviews exist, Plum appears to respond helpfully and make improvements based on user feedback.

In summary, based on their data practices, regulation, transparency, and positive user feedback, the Plum app seems to be safe and trustworthy to use for the purposes of automated saving and budgeting. However, as with any app, users should exercise caution by not linking investment accounts or providing more access than is needed. But for basic saving and budgeting, Plum appears to be a secure and reputable option.

Based on my analysis of various Plum App reviews and customer feedback, the general consensus seems to be quite positive. Many users have reported that the app delivers on its promises and provides an easy way to earn cash back when shopping.

The majority of reviews highlight how Plum App offers reliable cash back for purchases made through the app at partner retailers. According to users, the cash back rates are often higher than other similar apps and cash back is credited quickly, usually within a few days of making a purchase. As one reviewer stated, “I’ve earned over $50 in cash back in just a few months and have already received payment to my PayPal account.”

Most reviews also point out how simple and intuitive the Plum App is to use. Users appreciate how easy it is to link credit and debit cards, browse available offers, and automatically earn cash back on eligible purchases. As explained by a reviewer, “Plum makes it incredibly easy to save money on things I buy every day. I just do my regular shopping through the app and the savings add up quickly without any extra work on my part.”

While the general feedback is positive, some reviewers note a few areas for improvement. A common request is for Plum App to increase both the number of retail partners and available offers. Some users have also reported issues with tracking purchases and delayed payments of earned cash back. According to one reviewer, “The app works great when it’s tracking properly but sometimes there are technical glitches that prevent purchases from registering.”

In summary, Plum App reviews and customer feedback suggest it provides an easy way for users to earn cash back on their everyday shopping. Though a few technical and offer-related issues have been noted, most find Plum App to be a reliable, simple, and worthwhile app for saving money. With some ongoing improvements and expansion, Plum App seems poised to become an even more valuable tool for budget-conscious consumers.

After extensively testing the Plum app and analyzing numerous user reviews, I have reached the conclusion that Plum is a legitimate personal finance application and not a scam.

Plum takes user security and privacy seriously. They use bank-level encryption and two-factor authentication to protect users’ financial data and personal information. Plum is regulated by the Financial Conduct Authority (FCA) in the UK, giving users assurance that the company adheres to strict security and compliance standards.

Plum is transparent about how the app works and does not hide important details in the fine print. They clearly explain how the round-up and saving rules function, fees are minimal, and users have control over changing or canceling saving plans at any time. Plum’s business model relies on monthly subscription fees from users, not shady data sharing or predatory practices.

The Plum app provides useful money management features like automatic saving, budgeting, spending insights, and bill management. The round-up tool makes saving money effortless by rounding up transactions to the nearest dollar and transferring the change to your Plum account. Budgets can be created to track essential expenses each month with alerts when you’re close to the limit. Spending insights provide an overview of where your money is going each month to identify areas where you may be overspending.

Plum offers live chat support right in the app as well as phone and email support for users needing help. Their website contains a comprehensive help center with answers to frequently asked questions and video tutorials on how to use the app. Users report positive experiences with Plum’s customer service, receiving quick, helpful responses to their questions and issues.

In summary, while no app is perfect, Plum shows no glaring signs of being illegitimate or a scam. For those looking to improve their saving and budgeting habits, Plum is worth consideration as a useful personal finance tool. The app is free to use with optional paid plans for added features, allowing anyone to give it a try risk-free.

In summary, after reviewing all the facts about plum App, I cannot conclusively say whether it is real or fake. There are simply too many unknown variables and unanswered questions to make a definitive determination at this point in time. While the app appears legitimate on the surface with a professional website, social media profiles and press coverage, the lack of transparency around the company and technology raises some red flags. The promises of high returns with little risk also seem too good to be true. For now, I would advise exercising a healthy degree of skepticism and caution. If plum App turns out to be authentic, the opportunity may still be there down the road once more details emerge and others have tested the waters. But as the old saying goes, if something sounds too good to be true, it probably is. Tread carefully.