What Is the Current Deliveroo Share Price & What to Expect in the Future

You may be wondering what the current Deliveroo share price is and what to expect from the company in the future.

You may be wondering what the current Deliveroo share price is and what to expect from the company in the future.

Deliveroo is a food delivery service that operates in over 100 cities across 12 countries. The company has seen substantial growth in recent years, and its share price has increased along with it.

However, Deliveroo has faced some competition from rivals such as UberEATS and Foodora. This has caused its share price to dip in recent months.

Despite this, Deliveroo is still a strong company with a bright future. It is expected to continue growing at a rapid pace, and its share price is expected to rise once again.

Deliveroo, the food delivery company, is all set to go public. The company is expected to be valued at £1.5 billion when it lists on the London Stock Exchange (LSE) tomorrow.

You can expect a lot of interest in Deliveroo’s IPO, as the company has seen impressive growth in recent years. In 2017, revenues jumped by more than 250% to £277 million. And with a current share price of £48 per share, investors are looking to get in on the action.

The company is also loss-making, however, recording losses of £185 million in 2017. This is largely due to the high costs of expansion and the competition from rivals such as Uber Eats. Nevertheless, with a booming food delivery market expected to be worth £23 billion by 2022, there is still plenty of potential for growth.

Deliveroo is a food delivery company that you may have heard of. It was founded in London in 2013, and it has been growing steadily since then. The company is now worth an estimated $2 billion, and it continues to grow.

The current Deliveroo share price is $56.06. This may change in the future, but it is a good indicator of where the company is headed.

The Deliveroo share price is something that you may be interested in if you’re looking to invest in the food delivery market. The company is currently worth £5.5 billion, and it’s estimated that the Deliveroo share price will rise to £6 billion by 2020. This would make Deliveroo the second most valuable food delivery company in the world, behind only Uber Eats.

So what makes Deliveroo so valuable? Well, the company has a large market share in the UK and is continuing to grow at a rapid pace. It also has a strong international presence, with operations in over 150 cities across 28 countries. This makes Deliveroo well-positioned to capitalize on the growing food delivery market.

Analysing Deliveroo’s financial performance and outlook

As you can see from the table, Deliveroo has had a pretty impressive run since it was founded in 2013. The company has seen strong growth in both revenue and gross profit, with the latter increasing at a faster rate.

This is an encouraging sign, as it indicates that Deliveroo is becoming more efficient in how it generates revenue. The company’s operating expenses have also been growing at a slower rate than revenue, which is another positive sign.

Looking ahead, Deliveroo is expecting to continue growing its revenue at a strong pace. In fact, the company is targeting a revenue of £1 billion by 2021. This would represent a compound annual growth rate (CAGR) of around 50%.

There are a few things that will influence Deliveroo’s share price, and it’s important to be aware of them if you’re thinking of investing.

One of the most important things is Deliveroo’s revenue growth. In order for the company to be successful, it needs to continue to grow its revenue at a fast pace. This is because investors are looking for companies that have a lot of potential for growth.

Another important factor is Deliveroo’s margins. The company needs to have high margins in order to be profitable. This is because investors want to see that the company is generating a lot of income from its operations.

Finally, Deliveroo’s competitive advantages will also play a role in its share price. The company has a few competitive advantages, such as its large customer base, its efficient delivery system, and its strong brand name. These advantages give Deliveroo a leg up on its competitors, and investors will be looking for companies with strong competitive advantages.

The current sentiment surrounding Deliveroo’s stock is mixed. Some analysts are bullish on the company, believing that it has strong growth potential. Others are bearish, citing concerns about the company’s business model and high valuation.

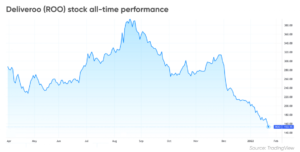

Overall, the share price has been volatile in recent months, and it remains to be seen how the stock will perform in the future.

As you can see, the Deliveroo share price has been on the rise recently. This is likely due to the company’s impressive growth, and there is no indication that this is set to slow down anytime soon. This makes Deliveroo a good investment opportunity, and it is likely that the share price will continue to increase in the future.